Newsletter 197 – 11.03.2025

Argentina is coming from a long complicated period for fruit production due to policies that affect the internal market and social conflicts. Productive economies suffered under a heavy tax burden, high costs and lack of profitability, leading to a shrinking sector and a drop in exports. Milei's government brought an abrupt change, seeking to normalize the economy, achieving a sharp drop in inflation and a shrinking of the State. The stability achieved and the lower inflation allows companies to be organized and provide predictability again. But the reactivation of the economy is taking time to occur due to the enormous public debt, years of imbalances and the lack of resources.

The evolution of the citrus sector is a clear example of the ups and downs of Argentine politics and economy. Years of crisis led to a reduction in the cultivated area and a drop in exports. Although the internal economy was not entirely responsible, global trends also had an impact, mainly in the case of lemon. This suffered under alternating periods of glory and very unfavorable years, such as the last ones. Years of expansion led to an oversupply and collapse in prices, which strongly hit the economy of Tucumán, which is the world's leading producer and industrialist of lemon. Faced with an unfavorable scenario, plantations were eliminated, some establishments closed and strategies were redesigned.

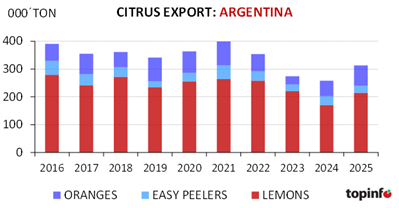

Due to the reduction in surface area, production also fell, which was felt in the export of fresh lemon. The minimum was reached in 2024 when 170,000 tons of fresh lemons were exported. In this case, external markets also had an impact, which in 2024 were unfavorable. 2025 looked more positive, due to declines in production in the northern hemisphere, which led to a recovery in southern exports, mainly in shipments to Europe and Russia. This compensated for the drop in exports to the US, which, in the face of a new North American trade policy, shrank. Exports in 2025 will be around 215,000 tons, +26% compared to 2024. But the levels of 2015-2022, when about 250,000 tons were exported, have not yet been reached.

In contrast to fresh exports, Argentina remained the leader in the industry. Grinding has remained around 1.4 million tons in recent years. Even for this campaign, it is expected to exceed this volume.

Sweet citrus suffered even more under the negative policies of recent years. Given the impossibility of exporting fresh fruit, Argentina lost importance as an international supplier in this sector.

The production of mandarins was fully devoted to the domestic market, with the mandarin being one of the most abundant and economical fruits on the local supply. High internal costs, absence of trade agreements, high tariffs and lack of investment in new varieties led to Argentine mandarins no longer being in demand in foreign markets. There are minimal exports to Russia, Canada and Southeast Asia. In the last two years, Brazil has been added as an attractive destination. But the European market has been lost due to lack of competitiveness, and the US market has not yet been opened. In the current campaign, production problems were added due to climatic adversities (excessive rain, hail, frost), a situation that was also suffered in 2023 and 2019. With all this, exports remain at low levels (24,000 tons), far from the historical levels of 30,000-50,000 tons.

In the case of oranges, the situation differs between industrial and fresh. The industry is flourishing in the face of the sharp production reduction of the two largest producers of orange juice, Brazil and the United States. The prices offered by the industries are attractive, which is why increasing volumes are industrialized. In the case of the fresh market, as with mandarins, most of it is sent to the local market. Only 6% is exported fresh. In 2025, exports will be around 75,000 tons. Two destinations are distinguished. On the one hand, there is the European Union, which receives about 20,000 tons annually, a fairly constant volume. The other great destination is Paraguay. Volumes fluctuate strongly, between 6,000-40,000 tons/year. They buy inferior qualities and it is a fairly informal business, which is reflected in the very low prices registered by customs. All other markets are rather smaller, sending limited volumes and little impact.

The total of fresh citrus fruits exported in this campaign will be above 310,000 tons, which shows a recovery compared to 2024 and 2023, when volumes were less than 300,000 tons. But there is still a long way to go, to reach the 350,000-400,000 tons, common a few years ago. The country's economy has normalized, but much is still missing, such as investments in improvements and new varieties, reduction of internal costs, improvements in the labor system, international negotiations, tariff reductions, etc. Thanks to the strengthening that Milei's government received in the last elections, the government plan will be deepened, working hard on labor and tax reform. This will benefit the fruit sector, whose development is hindered by the complex labor system and the high tax burden.