Newsletter 187 – 06.09.2025

For some time now, producers have been questioning: how much more can the demand for blueberries grow? Is there a limit? These are questions many are grappling with, and they are difficult to answer. So far, all signs indicate that blueberries continue their worldwide conquest. They seem to be the ideal fruit due to their flavor, color, shine, and size, in addition to their practicality and health benefits. Moreover, they are available year-round because they can be cultivated in many temperate and subtropical regions. Compared to other berries, they are more transportable, maintaining quality even after weeks of shipping by ship and truck. This makes them perfectly suited to the needs of current consumers and retailers. As often happens, some voices have raised concerns about the negative environmental impacts of blueberry cultivation and transportation, especially regarding water use, agrochemicals, and the plastic packaging required for marketing. However, these opinions have not yet gained enough traction to slow down the success of blueberries among consumers worldwide. Everything suggests that, for now, they will continue to be the “king of fruits,” and it remains to be seen how much their consumption can grow.

This situation looks different when analyzing this business from a production and commercial perspective: here, success is no longer guaranteed. For years, blueberries were a highly profitable crop, leading to widespread cultivation in many regions of the world. Supply grew year after year, and demand followed the same trend. Concerns over insufficient sales did not materialize, except in some specific cases. However, the problem was that prices could not be sustained at those high levels. The prices currently in the market are far from those of the past.

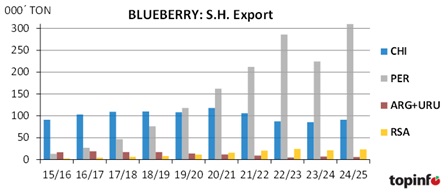

The 2024/25 season in the Southern Hemisphere, which just concluded, was no exception. Peru, the leading southern hemisphere exporter and the world’s top supplier, recovered after a downturn in 2023/24. Its production returned to full capacity, helped by the entry of young plantations into the production cycle. Peru closed another record-breaking season, surpassing 300,000 tons exported for the first time. Other Southern Hemisphere countries did not fare as well. Their expansion halted a few years ago, with exports stabilizing or even decreasing.

Chile, for instance, went from exporting 110,000 tons in 2017/18 and 2018/19 to 85,000-90,000 tons in the last three years. South Africa’s shipments stabilized around 20,000-24,000 tons. Argentina and Uruguay significantly reduced their exports, shifting to niche suppliers. From about 20,000 tons combined ten years ago, they fell to around 6,000 tons. The reasons are straightforward: the low prices paid make blueberry cultivation in these countries hardly profitable, and they cannot compete with Peru’s advantages. This is forcing competitors to change strategies or withdraw from the business.

However, even in Peru, the situation is becoming less favorable. Low returns are beginning to diminish profits and force businesses to reconsider, adjust, and become more efficient. Despite this, Peru will continue to grow. There is still a lot of land entering production for the first time. Additionally, cultivation techniques are improving, and some varieties are being replaced by newer, more efficient, richer, and more stable ones. As a result, the Southern Hemisphere’s supply will be even more dominated by Peru: it is estimated that in the upcoming season, 3 out of 4 blueberries from the Southern Hemisphere will be from Peru. Furthermore, with the ongoing varietal replacement, the blueberries will be of better quality, especially regarding flavor and post-harvest life. Nevertheless, prices are expected to remain low, except in cases of scarcity, as happened in 2023/24.