Newsletter 116 – 20.05.2021

Some years ago, no one expected that Chile, a country with temperate fruits, was going to be one of the main suppliers of southern citrus. To achieve this, the sector made several successful changes, which coincided with an increase in demand in the northern markets.

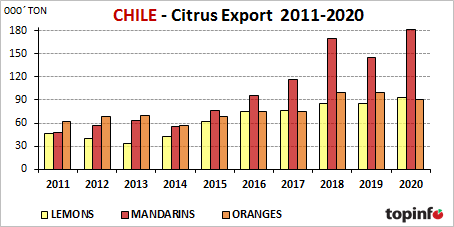

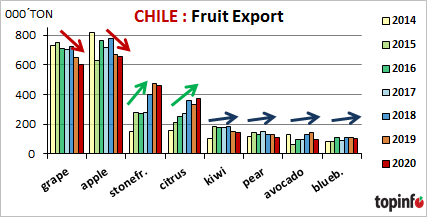

Chile is well known throughout the world for its temperate fruits, such as grapes, apples, kiwis or stone fruits. Traditionally it was not considered a citrus country. Its geographical position places it in the limit zone for a quality citrus production. For many years, the production was limited and destined in the first place to supply the local market. 70% of the production had this destination, exporting only about 20-30,000 tons. Lemons, some oranges and very few mandarins were exported the most to North America, Europe and Asia.

But, in the last 20 years, the scene has changed radically, with Chile currently being one of the main citrus suppliers in the southern hemisphere. This was achieved thanks to the changes made by the citrus sector and the favorable evolution in foreign markets, especially in the United States. The Chilean success is closely linked to the growing demand for off-season citrus in the US. In this market a great boom took place and most of the Chilean exports are directed there (86% of the total).

All the changes made by the Chilean sector and government were very positive and led to success, to the point that citrus fruits, which were a minor fruit, became important in Chilean fruit growing. Currently 14% of Chilean fresh fruit exports are contributed by citrus. A few years ago their share was 5-8%. Along with cherries, they are the fruits whose exportation is growing the most. While in other fruits the volumes shipped are stable (kiwi, pear, avocado) or are falling (apples, grapes), those of citrus are growing year after year.