Newsletter 111 – 24.02.2021

Season 2020/21: Chile – Argentina

CHILE: Extensive experience and a mature industry

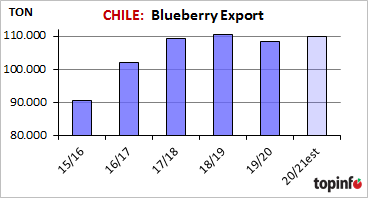

Chile was the pioneer country for southern blueberries. It has been growing and exporting blueberries for 30 years, being therefore a very mature industry, with a long experience. It was for many years the first southern exporter. Exports registered a strong upward trend, stabilizing in recent seasons at 110,000 tons. To the fresh blueberries, we must add the frozen fruit, of which last year it exported 45,000 tons. Therefore, the total export of blueberries was 155,000 tons.

Chile currently has a cultivated area of 18,400 hectares. More than half are in the central regions of Maule (32%) and Ñuble (22%). The southernmost regions, from Biobío to Los Lagos, account for 36%, while in the north, from Coquimbo to O'Higgins, the remaining 10% is located. Maule was the region that registered the largest increase in area in recent years. The cultivation also expanded in the southernmost regions, although at a slower rate. In the northern regions the surface is quite stable. Agro-climatic constraints and increasing competition held back enthusiasm for blueberries in these regions.

In its history, Chile was able to successfully solve its problems, be it due to the weather, plagues or commercial issues. In recent years, the world situation has been complicated by growing competition from new producers, such as Peru, Mexico and Morocco. This competition occurs especially at the beginning and end of the campaign. During the peak season (December to February) Chile continues to be the main supplier.

Faced with this situation, the Chilean industry reconsidered its strategies aiming to be a supplier of superior quality. Four years ago, the Chilean Blueberry Committee launched its quality verification program covering the different production and commercial aspects to ensure that quality fruit reaches the markets throughout the campaign. Among the fundamental pillars is the correct selection of varieties, production, harvest and post-harvest. One of the measures adopted is to encourage the export of varieties that ensure they reach consumers with quality and discourage those that do not guarantee sufficient quality at the destination. Quality standards were also raised, controls were intensified, and advice to producers and exporters was increased. The acquisition of technology, such as the purchase of optical sorting machines, was financed. The objective is clearly to bet on quality.

Regarding to varieties, a strong turnover has already been noticeable in recent seasons. In 2019/20, more than 50% of the export corresponded to 3 varieties: Legacy, Duke and Brigitta. Of these, Legacy and Duke, along with Draper and Emerald, belong to the group of "recommended varieties" by the committee. In the last 5 years its participation in exports increased by 10%. Brigitta, along with Jewel, Star and Ochlockonee, are from a group "with export restrictions" and their share fell 8%. The "non-recommended varieties" like O'Neil, are disappearing.

Another point in which Chile is making strong progress is in organic production. An increasing percentage of its fruit is produced under this system. In 2019/20, 15% of its exports corresponded to organic. For the current campaign, it is expected to reach 20%. The pandemic encouraged the shift towards this mode of production. Organic production is centered in the south of the country. The regions of Araucanía, Los Ríos and Ñuble contributed 67% of the organic blueberries exported by Chile in 2019/20.

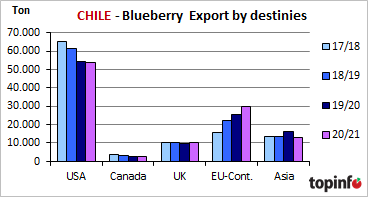

The current season was marked by the pandemic, a great interest in blueberries, increased sales, but also lower prices than in other seasons. The strong competition pushed prices down to the point of leaving the less efficient productions out of the system. There were plenty of climatic adversities, such as heat stroke, wind and rain. The season started early, registering its first peak in mid-December and the second in mid-January. Just as it started earlier, it will also end earlier, as the heat and rains in January accelerated the end of the season. It is estimated that it will end with a total of 110,000 tons exported, a volume very similar to that of the last 4 seasons. The US remains as the main destination, receiving half of the shipments. It is followed by continental Europe, which continues to grow. In less than 5 years, Chilean imports tripled. The plus from Europe offset the decline in the Far East, a destination that suffered due to lack of interest, commercial and logistical problems.

ARGENTINA: Reframes the goals

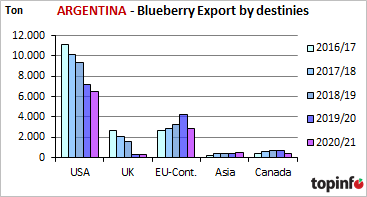

It was the classic early provider, being practically alone during October and November. Its industry is based on starting as soon as possible, for which it implanted early varieties, selected precocious regions and worked with air shipping. But the emergence of very strong competitors in the same period and with competitive advantages seriously complicated the development of the industry. It had to rethink its goals, focus on the most productive regions and farms, reduce costs and go from exporting volume to quality.

Like Chile, efforts are focused to transform into a quality supplier, taking advantage of the special taste of the Argentine blueberry. For this, a great varietal replacement is being carried out. The traditional varietal like O'Neil, Misty and Jewel are disappearing. Currently the Snowchaser, Star, San Joaquin, Farthing, etc. start to predominate.

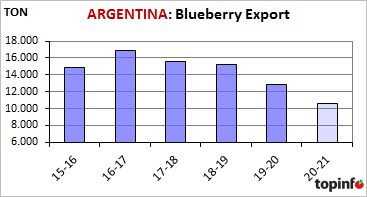

This season ended with an export close to 10,500 tons, 17% lower than 2019 and 30% lower than 2017 and 2018. This drop is due to high costs and lack of trade agreements. Given the lower competitiveness, the country specializes in niches or market segments that appreciate the good taste of Argentine blueberries. For this reason, the efforts are now focused on organic production, estimated to have reached 30% of the last export. With regard to costs, the aim is to reduce them through a greater turn towards maritime shipping. In the current season, for the first time it was possible to send more volumes by ship (57%) than by air. In previous years only 10-20% was shipped by boat. Another point in favor is the elimination of the fruit export tax that the government implemented a few weeks ago.

As an advantage over neighboring countries, Argentina has a local market of growing importance. In recent years, the Blueberry Committee carried out successful advertising campaigns to disseminate and encourage internal consumption.