Newsletter 120 – 06.08.2021

During the last 10 years the table grape industry has shown great dynamism, especially in the southern hemisphere. The business grew, but so did the challenges. In a few years suppliers of some importance disappeared, others emerged and grew so rapidly that today they dominate the scene. The importance of destinations was also modified. Traditional markets are no longer the most attractive ones. Today, the interest is focused on new markets that are very promising.

Increase in southern arrivals

The table grape was one of the most successful fruits in recent years and within these it was especially those from the southern hemisphere that gained ground. Chile, as a pioneer in this business, did a great initial job 20-30 years ago, to which the other southern countries later joined.

Some of the reasons that explain this phenomen are:

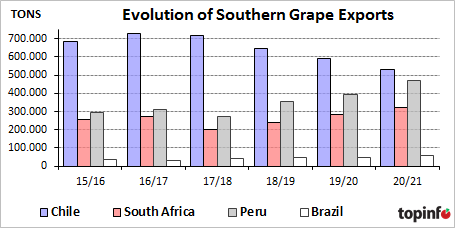

Thanks to this, shipments from the southern hemisphere grow each year. The exported volumes increased 50% in the last 20 years, from 0,9 million to the current 1,4 million tons.

CHILE

It was, 10-15 years ago, the main supplier of southern grapes. It was the most successful fruit when it started to supply fruits to the world. Thanks to this, it became the world's leading exporter, supplying mainly the North American and European markets with grapes during the winter.

For many years, grapes were the most exported fruits by Chile. But after many years of full expansion and dominance, the situation got complicated. In the first place, new competitors emerged, with advantages over Chile, which began to dispute the markets. Plus, there were other factors such as the growing water problem, with grapes demanding more of this scarce commodity than other crops. Another factor was the varietal replacement, which was not easy for Chilean producers to deal with.

10 years ago Chile exported more than 800.000 tons, but these levels could not be sustained in the following years. Since 2012/13, the results of the seasons have decreased gradually until reaching a total 534,000 tons in the last one, which is a decrease of 35%.

Besides the drop in exports, the Chilean contribution to the total southern export also decreased. From contributing 70% of the total exports of the hemisphere, it went on to contribute 38% in the last season.

PERU

Peru strongly expanded its grape production, a process that also occurred in other crops such as blueberries and avocados. The advantages of Peru are its even climate, without the heat or cold strokes that characterizes other regions. In addition to a large availability of land, relatively cheap labor and the low incidence of pests and diseases.

Along with the expansion of the crop, so did the export. While in 2010/11 Peru exported about 90,000 tons, this year the season ended with 470,000 tons. In other words, exports have quintupledo in this period, thanks to an intense and sustained growth, supported by the incorporation of new hectares, improvements in the way of production, higher yields and a strong varietal change, from the classic Red Globe to the new patented varieties.

SOUTH AFRICA

South Africa also expanded its grape production and export. This country has several producing regions, which allows it to have a long supply period and absorb possible losses due to climatic problems in one area, with higher harvest in other ones.

In 2010/11 South Africa exported approx. 202.000 tons while in 2020/21 the result was 60% higher, reaching 323.000 tons. Although South Africa has experienced considerable growth, it has not been as marked as in the case of Peru. From 2016/17 to now, volumes have remained relatively constant (between 250-300 thousand tons) and this last season registered higher growth and record volumes.

BRAZIL

Brazil has registered a quite constant export between 30-60.000 tons. The fluctuations from one year to another depend on the harvest, on the exchange rate and also the volume consumed by the domestic market, which in the case of Brazil is very important. Its contribution to the southern export is of 3-5% and has not changed significantly in recent years.

Changes in destinations

No sólo los proveedores han sufrido cambios, también los mercados. Para Chile During the last 5 season an important growth in exports to Europe, USA and Canada was observed. Exports to Europe and USA increased by 25-30%, this is the equivalent of +78.500 and +91.300 tons respectively. Volumes sent to Canada practically doubles (+21.800 tons). There were also slight increases in exports to Russia. The Far East on the other hand received approximately 20% less, which is the equivalent of -64.800 tons. The markets of Middle East, U.K. and Latin-America remained relatively stable with small increases in the first case and slight decreases in the other two.

Peru se orienta cada vez más al mercado norteamericano. Mientras que en 2010/11 le destinaba el 26% de sus exportaciones, hoy en día este porcentaje ha escalado al 46%. Europa mantiene su participación algo más estable, entre el 25%-27%. Los mercados que se han retraído han sido el Lejano Oriente-Asia (del 27% cayó al 16%) y más aún Rusia (del 12% al 3%).

En el caso de South Africa los cambios no han sido tan marcados. Este país dirigía en 2010/11 el 75% de su producción a Europa, siendo Asia el segundo destino en importancia con el 18%. En la actualidad, si bien Europa se mantiene como el principal destino sin haber modificado sustancialmente su importancia, es en los mercados secundarios donde se han visto algunos cambios. Los destinos asiáticos han retrocedido al 14% y Norteamérica ha comenzado a ganar importancia, con el 7%.