Newsletter 127 – 13.12.2021

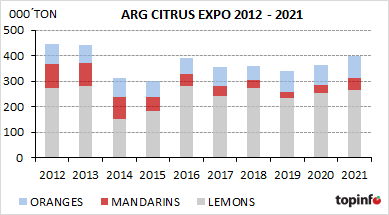

After several years in which production, cost and market problems complicated exports, there was a recovery. This was mainly for mandarins, but more oranges and limes were also exported than in previous years. Despite the export plus, it was not an easy season due to the many complications that arose.

This year Argentine citrus exports recovered, reaching 400.000 tons. In the last 7 years this value had not been achieved, while prior to 2013 it was usual to export more than 450.000 and up to 680.000 tons. Therefore, there was a partial recovery in exports. The 3 citrus fruits exceeded the exported volumes of 2020, as well as the average of the last 5 years. The greatest increase occurred in mandarins (+ 54%), while in oranges and lemons the plus was lower (+ 8% oranges, + 3% lemons).

It should be noted that the recovery occurred despite the new, very strict provisions imposed at the beginning of the year by the European Union after the phytosanitary conflict last year. It was only in May that Argentine citrus fruits were allowed to enter the EU and in the first weeks little was shipped, because it was difficult to implement the new requirements. Some exporters even failed to comply with the complex provisions and stopped shipping their citrus to the E.U. But the lower shipments to the EU could be offset by higher shipments to other destinations, such as North America and the Far East.

It should be noted that the recovery occurred despite the new, very strict provisions imposed at the beginning of the year by the European Union after the phytosanitary conflict last year. It was only in May that Argentine citrus fruits were allowed to enter the EU and in the first weeks little was shipped, because it was difficult to implement the new requirements. Some exporters even failed to comply with the complex provisions and stopped shipping their citrus to the E.U. But the lower shipments to the EU could be offset by higher shipments to other destinations, such as North America and the Far East.

Another problem for Argentina is the strong competition from the other southern countries. South Africa and Peru registered new export records, flooding the northern hemisphere markets with their citrus fruits. Besides, there were logistical problems of maritime transport, causing many delays this season. Due to this, the transit time was lengthened by 1 to 3 weeks, altering the initial plans.

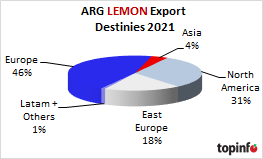

LEMON

Everyone who is in this business knows very well the ups and downs that this business undergoes. A favorable situation can turn into an unfavorable one in just a few weeks. In the season that has just ended, both situations were experienced; moments in which very attractive prices were paid, as well as moments with historically low prices. In the EU, the season started with low prices, given the large Spanish production. Then, the delayed start of the southern season, added to the delays due to logistical problems, led to lower volumes arriving in Europe during the first weeks and the market recovered, paying attractive prices.

But towards the end of the season there was a concentration of arrivals, due to logistical delays and scheduling mismatches. This large volume was very difficult to sell and prices dropped. A similar situation was experienced in the USA. The first part of the season was positive, with limited availability and attractive prices. But in recent weeks the market collapsed due to an excess of supply and delays in arrivals.

Argentina sent very important volumes to the USA, doubling those of the previous year. With this, the United States became for the first time the first buyer of Argentine lemons. It was the North American market that largely saved the Argentine season; given that both Europe and Russia received lower volumes than usual. There was also an advance in the Far East, especially in China, although the increase in shipments was much more moderate than in the case of the USA.

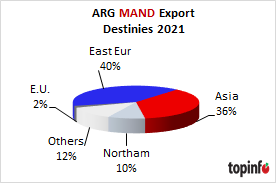

EASY PEELER

The easy peeler, which at some point was a star in Argentine fruit growing, suffered in recent years from unfavorable weather conditions that reduced its production, as well as a loss of competitiveness in foreign markets. The latter was due to several causes: tariff disadvantage compared to competitors, old varieties, high internal costs, increasing competition from late mandarins in the northern hemisphere.

But in this last season, circumstances were somewhat more favorable. Production recovered, added to the growing interest of the northern markets for southern mandarins and a more favorable exchange rate, led to exports reaching almost 50.000 tons again, which is +54% than in 2020 and +38% than the historical average. It was possible to send larger volumes to Russia again, thanks to which it regained its place as the first destination for Argentine easy peelers. There was also a plus in shipments to Asia, especially Southeast Asia. As minor destinations, Canada, the Middle East and the former Soviet Republics remained.

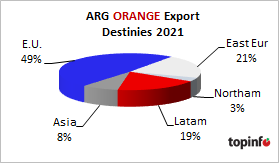

ORANGE

Until the end of October, exports reached 83.000 tons, a volume that is 8% higher than those of 2020 and 18% higher than the historical average. It should be noted that this increase is due to higher shipments from overseas, and not to neighboring countries. First is Europe. The old continent usually receives a third of Argentine exports. But last year there were phytosanitary problems and just when full export began, the entry of Argentine citrus fruits to the E.U. was prohibited. This strongly affected shipments of oranges to Europe, which had to be diverted to other markets. Therefore, in 2021 this market recovered, despite the fact that the new requirements were not easy to meet.

More was also shipped to Eastern Europe and Canada. This plus offset the lower shipments to Paraguay. This country is an important buyer of oranges, in some years it was the first Argentine destination. But the prices paid by there are extremely low, being well below that of other destinations. Therefore, it becomes important in terms of volumes, but not as monetary income. In the current season, as the share of northern hemisphere destinations increased, there was a greater increase in the value of exports, which were 14% above 2020, while the increase in volumes was of 8%.