Newsletter 138 – 08.08.2022

According to our evaluation, this has been an unusual season in terms of volumes, but normal in terms of prices.

SEASON

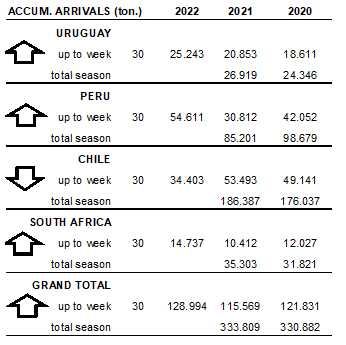

The season began early and was quantitatively important for Uruguay and Peru: both countries began earlier and at a higher initial shipping rate than in other years. This plus of shipments was maintained during the first half of the campaign. South Africa experienced a similar situation. In contrast to the favorable campaign of these countries, there is Chile, which registered a season with a strong reduction in shipments.

At the end of July (week 30), arrivals to the US from the different southern countries showed the following scenario:

PERU: EARLYNESS COMBINED WITH SIGNIFICANT GROWTH IN QUANTITY

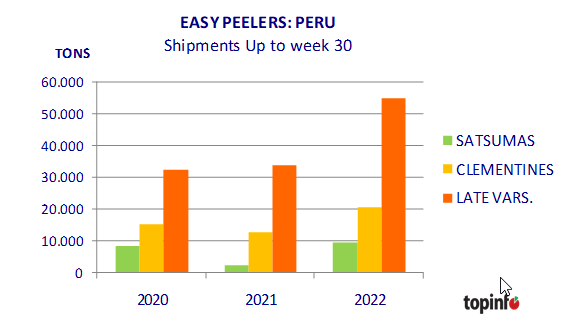

In the case of Peru, the main supplier in the first half of this season, it should be acquainted that it significantly increased its shipments to the US. In this way, USA has become the main destination for Peruvian mandarins. Approximately 66% of Peruvian mandarin shipments to date (week 30 included) were destined for the US, while in 2021, on the same date, they represented 38% and in 2020, 49%.

Peru already began to ship late varieties to the US in week 14, in a growing range of 1.0-5.6 K tons per week between weeks 14 and 26, and exceeding 10 K tons per week as of week 14. 27. Chile, on the other hand, only reached 1.0 K tons of late varieties in week 30.

According to private sources, this year, the increase in Peruvian shipments has occurred in both Satsumas and Clementines (especially Primosole), but fundamentally in late varieties (especially Tango).

CHILE: 40% LOWER EXPORTS

Chile's lower production is due to several factors.

One of the most important is the drought that Chile has been suffering in the last 10 years and that was very severe in 2021. During the summer and autumn the rains and snowfalls were scarce, so most of the reservoirs had a significant deficit, being this deficit higher than in previous years. The regions of Coquimbo and Valparaíso are among the most affected and where most of the Clementine production is concentrated. Initial estimates showed a lower export of clementines than in 2021, reaching 45 K tons (-35%), this being the most affected citrus.

In June and July the water situation improved, but the rains also interrupted the citrus harvest. To this was added that at the end of May and in July there were frosts in the citrus regions that caused damages. To this must also be added the tendency to plant more late varieties to the detriment of other mid-season varieties.

The Chilean clementine season ended with a total export of 41,000 tons, this is 40% less than in 2021, when 70,000 tons were exported, and 20% less than in 2020, when 51,000 tons were exported.

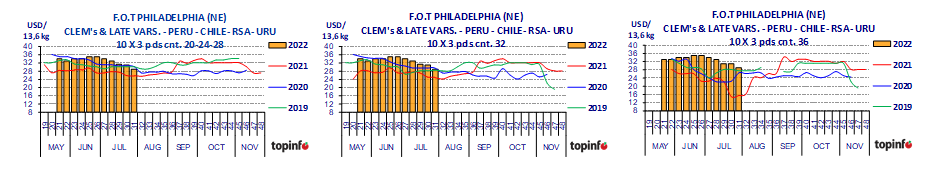

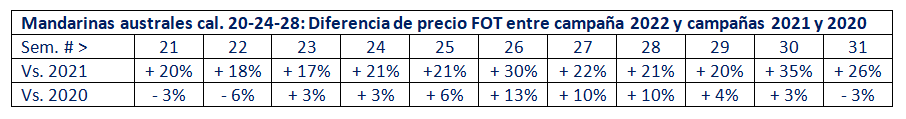

MARKET: FOT PRICES

Regarding the FOT prices, this first half of the season the average of the FOT of the four countries was higher than the average of 2021, despite having arrived larger quantities in the same period. This difference far exceeds US inflation. As an example we can see the prices of sizes 20-24-28 corresponding to the first half of the season. For the smaller calibers (32 and 36), the difference is even greater.

CONSUMER PRICES AND NUMBER OF ADS

From week 21 to date, consumer prices of clementines and tangerines in value-added packs (x 2 lb, x 3 lb) were generally 8-30% above those of 2021 and 2020. The number of ad did not show a definite trend.

FINAL COMMENT

At the moment, the total amount of mandarins arriving in the US is 11% higher than those arriving on the same date in 2021. We can say that so far this season there have been no moments of excess fruit in the retail channels. It can also be affirmed that the greater quantity arrived did not negatively affect the evolution of FOT prices.

Has demand improved?

Does inflation disguise higher consumer prices?

It would be risky to give a specific answer; the truth is that the current season is having a quiet evolution in terms of prices, despite the atypical situation in terms of arrivals.

We can say that the second half of the season, with a clear predominance of late varieties, should not present any unpleasant surprises, unless there are highly concentrated arrivals in any week.